The Spread Thread @SpreedThread1

Former head of credit strategy | Investor/Trader | 15 years on Wall Street were enough… Joined September 2011-

Tweets145

-

Followers268

-

Following697

-

Likes0

Would I buy this debt now? No. A yield closer to 20% is a more appropriate target. However, we want to highlight situations where the equity could be dead money (as is often the case post-bubble) but the debt may have value. More to come on some other busted converts... 7/7

3) Competition will increase. The current 70%+ transaction margin will attract competitors like Fidelity, who is already entering the space 4) At ~$200mm of EBITDA, COIN is FCF breakeven. This would be terrible for the stock, but “enough” for the '26 convert to get repaid. 6/7

A few reasons the bonds may be better rel val vs the stock: 1) To get 13% per year return for 3.5yrs (i.e. same as the '26 convert) puts the stock at $83, or ~27.5x on '25 EBITDA, a premium to peers. 2) COIN relies heavily on dilutive stock-based comp. Last 3 Qs were $350mm+ 5/7

Using a stressed scenario where EBITDA remains at 2022 levels, they still have enough cash to repay the $1.4b ’26 maturity. Of course, things can get worse than this. 4/7

The 0.50% '26 is worth a look vs the stock given it is the 1st maturity and COIN's $5b of cash. Using sell-side est, here is a cash walk through '26 ("other" includes my est. of addtl recurring cash outflows). In this scenario, COIN has enough cash to repay the '26 bond. 3/7

First up: Coinbase Disclaimer: This is a focus on rel val, not a crypto discussion COIN has 3 unsecured bonds totaling $3.5b. The nearest maturity is a $1.4b 0.50% convert due '26, convertible at $370.45 (i.e., busted or far out-of-the money), trading ~67. 2/7 Capital structure:

Dumpster diving in busted converts! We will focus on a few names in the next month or so. Many know these equities well – this is a way to look at the same companies from a different angle (converts/ debt). 1/7

Quick clarification based on responses. Yes, 25 is obv most likely. I’m just saying Powell must be worried whether inflation will fall to and remain at 2% if the labor market stays tight and fin cond are easing. If they signal 25 and the SPX rips to 4200, he will be more worried

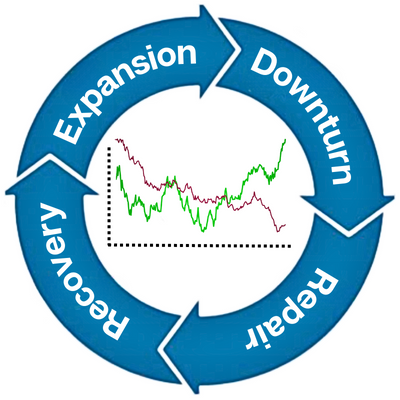

Interesting dilemma for Powell. Middle of the road inflation report. Inflation clearly coming down, but services sticky, while the labor market remains tight and financial conditions are easing. Does Powell push back on that by floating 50bp is still on the table?

Similar chart showing the deterioration in small biz lending conditions…

Similar chart showing the deterioration in small biz lending conditions…

Assuming $100mm of actual cash interest and ~$200mm of capex, they need $300mm of EBITDA to break even on FCF. Consensus for next year's EBITDA is negative $250mm.

Following up on BBBY, here is a simple waterfall on the equity value using sell-side estimates for FY'26 EBITDA and actual EBITDA 2yrs ago. For context, BBBY said they did negative $225mm of EBITDA last Q.

Following up on BBBY, here is a simple waterfall on the equity value using sell-side estimates for FY'26 EBITDA and actual EBITDA 2yrs ago. For context, BBBY said they did negative $225mm of EBITDA last Q. https://t.co/DuMapKxX7V

BBBY up on M&A speculation. With bond <$10, ~150mm of cash, and a terrible Q4 pre-announce, odds are they file. Plus, a BuyBuyBaby sale pre-filing opens up fraudulent conveyance risk. When retailers get into trouble, suppliers tighten payment terms, often a death spiral to ch.11

Of course, timing is the hard part. I am open to the idea that it could 'feel' like a soft landing for several months. A point I've made many times - the economy moves slowly. But the data does not support a true soft landing. Would love to hear what I'm missing... 7/7

In the one true soft-landing, 1994, the Fed started cutting rates just 5 months after they finished hiking as the economy began to stall in early '95. If policy REMAINS highly restrictive, as the Fed is suggesting, a soft-landing would be truly unprecedented. 6/7

Also, a common misperception is that once the Fed stops hiking, the tightening is done. Even ignoring QT, remember, if the Fed gets ~5% and stops, the drag on the economy from restrictive policy remains, arguably grows over time (more co's have to refi over time, etc...). 5/7

Per the LEI index, "workers...usually work fewer hours when employers plan to lay off workers in the future." I get it - we all see what we want to see in the data, but is this really good evidence of a soft landing? (LEI Avg workweek chart below) 4/7

Zandi says businesses are using other ways to reduce labor cost - "pulling back on hiring, cutting hours, cutting temp help." But is this not EXACTLY what happens as business activity starts to slow before companies start laying off workers? 3/7

Is labor supply coming back in a big way? Is the Fed going to cut rates to neutral soon? Something else? Or is this soft landing call just a guess that employment will hold up? 2/7

And note, while many "expect" a recession, market internals suggest they may not be positioned for it. Positive economic surprises late last year coincided with a big rotation into cyclicals like Industrials from Tech. May be time for that trade to reverse for a while. 3/3

Hilde @Paukouj530

23 Followers 975 Following My hobbies include eating and complaining that I’m getting fat.

Mabel @pT56yHNH9keBEn

7 Followers 907 Following

BeverlyO’Neil @5SSf56QbW0lE9k

15 Followers 794 Following In order to be irreplaceable one must always be different. — Coco Chanel

Laurence @CBxM3R961w4w6b

11 Followers 821 Following

ReneeRalph @Op3bRQYo6943n2

24 Followers 1K Following

Oxaumib @Oxaumib9225605

42 Followers 2K Following

FibLevelsPro🇺🇸 @Cralvir34999

44 Followers 2K Following 15-30% Monthly | 2 High-Conviction Stocks.Short-Term Gains: 15-20% in Days/Weeks.DM "JOIN" for WhatsApp Alerts. Live Trade Signals • Market Analysis

BiotechCatalyst🇺�... @Pralwuil6694

25 Followers 2K Following 15-30% Monthly | 2 High-Conviction Stocks.Short-Term Gains: 15-20% in Days/Weeks.DM "JOIN" for WhatsApp Alerts. Live Trade Signals • Market Analysis

Karjo @Karjo107809

26 Followers 764 Following

Tim Guo @TimGuo20

58 Followers 626 Following

WG P @JBSmith63401430

37 Followers 162 Following Freelance, data, excel model builder. History fanatic and funny quotes collector.

SW @n55136

2 Followers 37 Following

Bhu @insearchofhumor

313 Followers 4K Following mostly here to learn. occasional sarcasm. views my own, not investment advice.

AVan @AVan27980438

6 Followers 116 Following

Ashlee Lewis @AshleeLewi91577

922 Followers 4K Following We offer free short crypto pumps twice weekly. More than 1 million in our telegram channel participate weekly in our pumps. 👇👇

Diggs @easilyhumbled

50 Followers 126 Following

BMPNolan @BMPNolan

18 Followers 1K Following

Sanjyboy69 @sanjyboy69

78 Followers 980 Following BANKER/ADVENTURER/SPECULATOR/REAL ESTATE TYCOON/GOOD FAMILY MAN/ALL ROUND TOP LAD

Scott Valentin @scottvalentin

19 Followers 1K Following

XrisAkel @XrisLondon

37 Followers 394 Following

Ken Follettt @kenfollettt

4 Followers 407 Following

Master chief @Masterc80080180

3 Followers 153 Following

chris fitze @ChrisFitze

6 Followers 74 Following

whatsupsimmer @whatsupsimmer

173 Followers 816 Following

Davy Jones @thalamsd

101 Followers 1K Following

Cool Rick @MDennis99

70 Followers 701 Following

Chuck McMullan @McMullanChuck

84 Followers 1K Following Humanism and Humor. History and Finance. Music, always music.

Bafo @BafoBade

16 Followers 2K Following

Algonkin Volwalker @domsp_slayer

109 Followers 327 Following

Michel Cassard @michel_cassard

7 Followers 643 Following

patton @Pattontxiki

159 Followers 2K Following

Akshay.K @Akshay_Kumar13

68 Followers 167 Following

Jonathan Calhoun @CalhounJ1

134 Followers 625 Following

jeff l @PraiseTheLorden

8 Followers 143 Following

MRM @__mailman__

171 Followers 3K Following Random musings so I can look back & say "what was I thinking?"

Verissimus India @verissimusindia

230 Followers 632 Following The media arm of India’s financial awakening.

goleopards2009 @wimpykid0323

26 Followers 392 Following

BMPNolan @BMPNolan

18 Followers 1K Following

Scott Valentin @scottvalentin

19 Followers 1K Following

matmat @mMMtj

78 Followers 558 Following

Jin H @JinH27

13 Followers 238 Following

mike @hoosier_631

42 Followers 583 Following

Fringe Finance @fringe_fi

80 Followers 486 Following Falsification is the pathway to true knowledge, however messy and time consuming. Confirmation isn't.

Urban Cowboy @The_UrbanCowboy

36 Followers 803 Following

Oliver Keane @olzike

5 Followers 5 Following

Trill Bill @trillspot

423 Followers 789 Following I like food more than I hate successful people. Purveyor of inconvenient facts. Definitely not financial advice.

research_screen @research_screen

1 Followers 28 Following

Mateus Moura @Mateusrvmoura

6 Followers 105 Following

LCplCliff @LCplCliff

19 Followers 193 Following

Dddddddd @dddddd321123

63 Followers 804 Following

Jose @JoseCSilva77

35 Followers 643 Following

SPG @BPCSPG

71 Followers 615 Following

Brian Walton @Brian_Walton1

299 Followers 1K Following

Shep @Shepless

96 Followers 279 Following

Burton M @RealBurtonM

374 Followers 556 Following USMC Vet | Classical Liberal | Gen X | Financial industry drone since 1995 (at some point you’re just stuck)

BJang63 @BJang63

65 Followers 577 Following

Dean Malenko @PaulMi55thenet

251 Followers 2K Following

Graeme Stahl @StahlGraeme

40 Followers 300 Following

Brandon Born @BrandonCBorn

239 Followers 3K Following

The Doom Feed @TheDoomFeed

135 Followers 565 Following Your impending fate, curated from around X. Retweets are to capture sentiment/events; not necessarily statements I agree with.

Casey Clarke @CaseyClarke311

107 Followers 365 Following Truth, integrity, decency, compassion. Be curious. Ask questions. Apolitical. Total health vs. Pharma-centric health. Incentives drive behavior. Think.

QueensBridgeJaPaisa @QueensBridgeJaP

138 Followers 393 Following

Adi @javidnama06

10 Followers 113 Following

GeneralistJeff @GeneralistJeff

31 Followers 61 Following

Michael James @mikejames7337

328 Followers 845 Following

mark herman @vol_is_skewed

182 Followers 202 Following