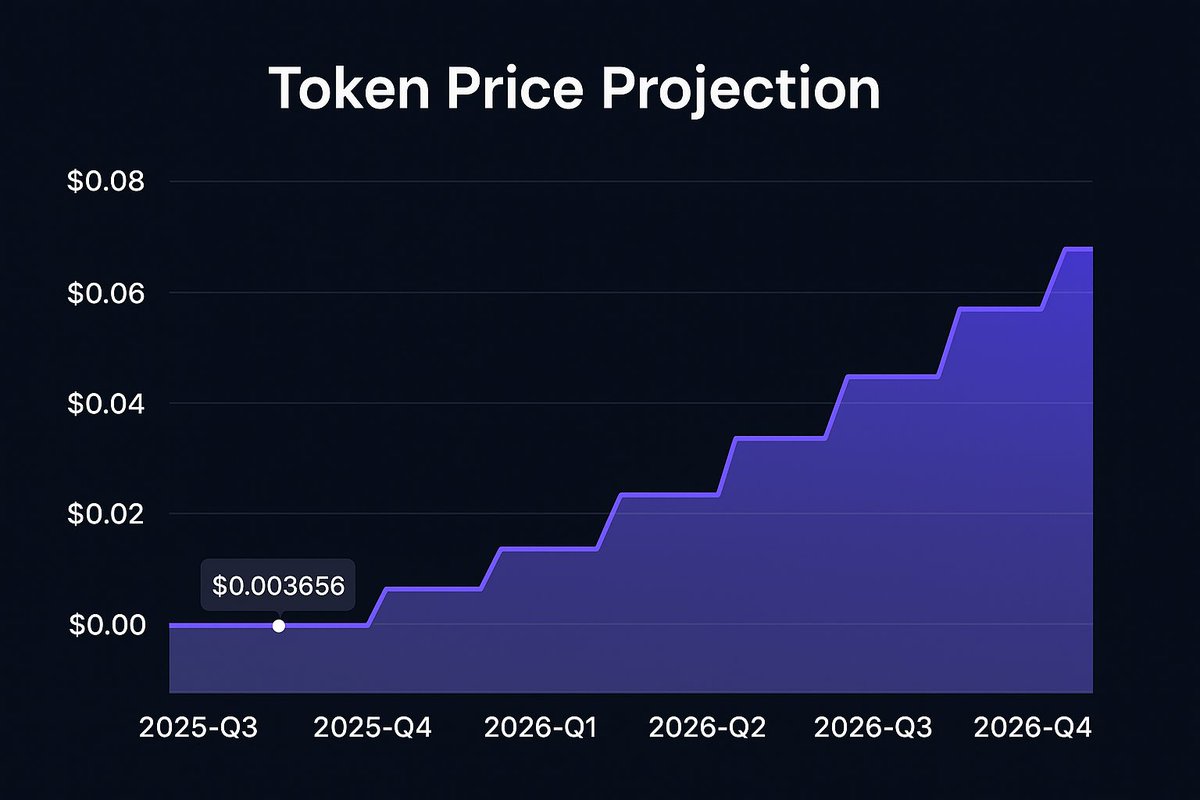

Realistic 20x on $SHEKEL? Yes, here's why! 🤫 I asked ChatGPT to give me a valuation framework for $SHEKEL based on 762k annualised revenue! 🧮

🏗️ Valuation Model Assumptions: Total Supply: 1B $SHEKEL Circulating Supply (2025-Q3): 30% staked = 300M 12.5% in LP = 125M 22.15M locked in agent setup fees ➝ Circulating ≈ 553M $SHEKEL Revenue so far (Apr–Sep 2025, ~6 months): $367.9k Annualised Run Rate (based on last 6 months): $736k Q3 revenue alone: $367.9k → suggests sharp growth, since Q2+Q3 basically generated all revenue. Revenue Use: 100% token buybacks (reduces circulating supply, increases demand) Agent Setup Fee: 50k $SHEKEL burned/locked AUM (2025-Q3): $332k across 443 agents (≈ $750 avg per agent) Growth Scenarios: Conservative: +25 new agents/month (≈ 300/year) Base: +50 new agents/month (≈ 600/year) Aggressive: +100 new agents/month (≈ 1,200/year) Valuation Multiples: 10–20x revenue (optimistic Web3 SaaS style)

@0xethermatt @KosherCapital @virtuals_io @base Big if true...

@0xethermatt @KosherCapital @SonofAdam777_ @virtuals_io @base Great analysis👏👏

@0xethermatt @KosherCapital @SonofAdam777_ @virtuals_io @base .1 or the market is wrong.

@0xethermatt @KosherCapital @SonofAdam777_ @virtuals_io @base Thanks. Made me more bullish about $shekel

@0xethermatt @KosherCapital @SonofAdam777_ @virtuals_io @base Interesting framework, add unit economics and TAM to a steady 20x