🚨 America’s money supply just broke a record. There’s now $22.1 trillion circulating in the U.S. economy. That’s more than at any point in history even during the peak of the COVID stimulus era. (a thread)

Let’s back up: when we talk about the money supply, we’re usually referring to M2. That includes the total cash in your wallet, your checking/savings accounts, and short-term investment funds you can quickly convert to cash. In short, it’s the money you can spend.

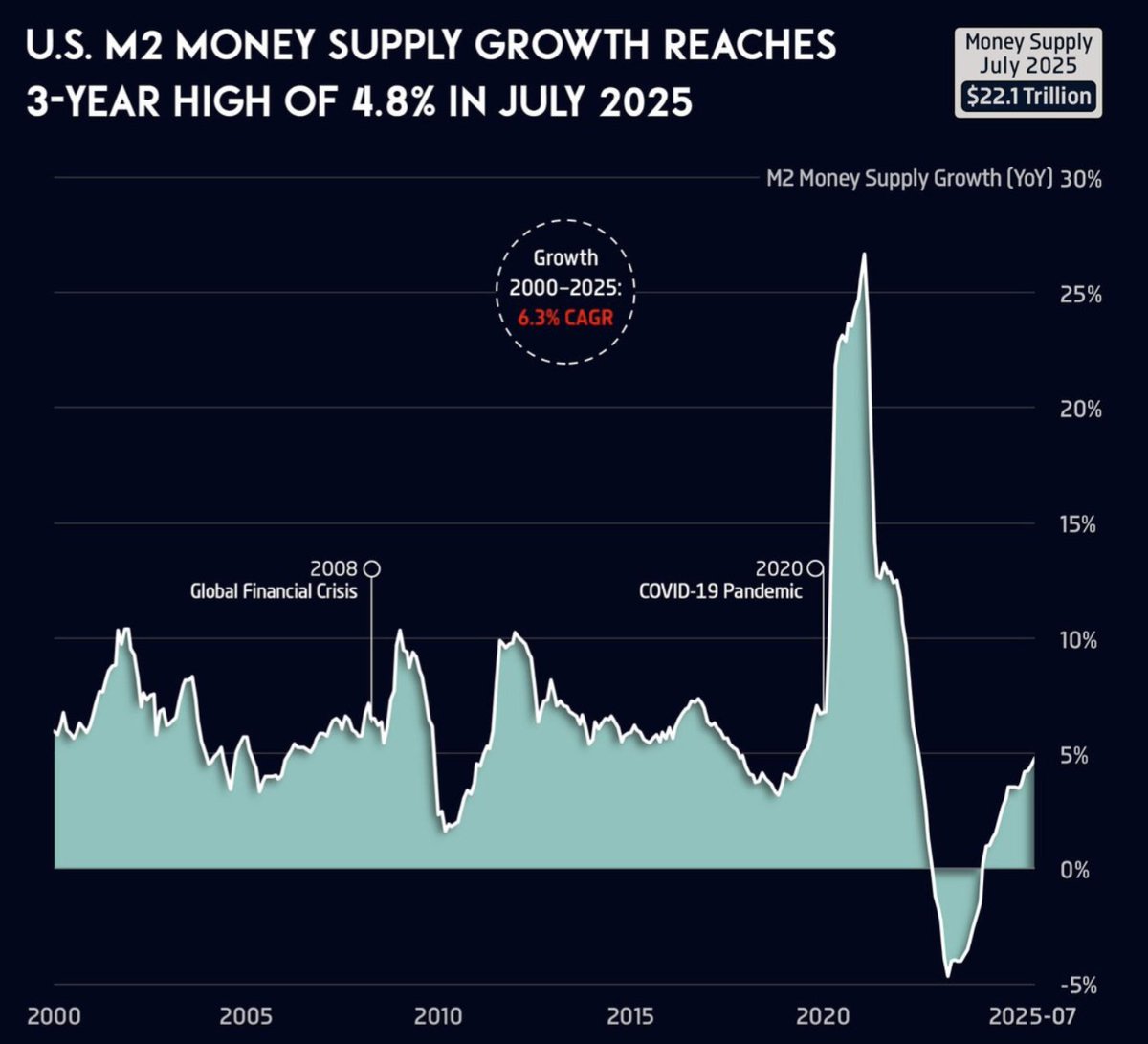

After shrinking for the first time in 90 years in 2023, M2 is now growing again. In fact, it just rose 4.8% year-over-year in July, the fastest rate since early 2022. And the total supply? A staggering $22.1 trillion.

So why is the money supply growing again? It’s not the Fed hitting the printer. It’s a combo of: • Massive government spending • The Treasury draining its cash reserve • The Fed stepping back from aggressive tightening

First: deficit spending. When the government spends more than it earns in taxes, it borrows the difference. That borrowing creates new deposits whether through Social Security payments, defense contracts, or infrastructure spending. Those deposits = more M2.

We’re now 10 months into the 2025 fiscal year… and the deficit has already hit $1.63 trillion. That’s $109 billion more than the same point last year. And the year’s not even over yet.

Why does that matter for the money supply? Because every time the Treasury Department pays a contractor, cuts a Social Security check, or sends out benefits, those dollars don’t just vanish. They land in someone’s bank account and that pushes M2 higher.

Next: the Treasury General Account, or TGA. Think of it like the government’s checking account at the Federal Reserve. When Treasury draws down this account say, to fund bills, it moves money from the Fed into commercial banks. That inflates the money supply too.

From late 2024 through mid-2025, the Treasury spent down over $450 billion from the TGA. Every dollar spent shows up as a deposit somewhere: A business, a retiree, a local government somewhere. And that’s another injection into M2.

Then there’s the Fed. After two years of Quantitative Tightening (QT), where it shrank its balance sheet by letting bonds roll off, the Fed has recently slowed its pace. That means less money being drained out of the system.

QT is the reverse of QE (Quantitative Easing), where the Fed buys assets to pump money into the economy. By slowing QT, they’re no longer soaking up liquidity at the same pace. That pause helps explain part of the money supply growth.

So where is all this cash going? A big chunk is sitting in money market funds, low-risk investment vehicles that function like high-yield savings accounts. They invest mostly in short-term U.S. government debt.

Retail money market fund balances just hit $2.2 trillion, up nearly 17% year-over-year. That’s more than triple their size in 2017. It shows investors are parking cash and waiting likely for interest rates to drop.

Total U.S. money market fund assets are now a record $7.5 trillion. And 76% of that is held by just five firms: Fidelity, Schwab, J.P. Morgan, Vanguard, and BlackRock. That’s a lot of idle capital…for now.

If interest rates fall? That cash could flood into: • Stocks • Housing • Commodities • Consumer goods Which could reignite inflation or fuel another asset boom.

This is where velocity of money comes in. Velocity measures how often each dollar changes hands. A high velocity means people are spending rapidly. Right now, velocity is low but if it rises alongside M2? Watch out.

We’ve seen this before. In 2020, M2 exploded upward. Inflation didn’t show up immediately, it lagged. But when velocity finally picked up in 2021, inflation surged.

Here’s the long-term picture: • Since 2000, average M2 growth = 6.3% per year • In 2020: up 25% • In 2023: actually shrunk • In 2025: growing again The cycle is turning quietly.

So what’s happening now is what economists call fiscal dominance. That’s when government spending becomes so large and persistent, it overshadows whatever the central bank is trying to do with interest rates or the money supply.

The Fed may want to hold rates. But if the government keeps running trillion-dollar deficits plus paying $1 trillion a year in interest alone money keeps sloshing through the system. And that money eventually moves.

The bottom line: America didn’t announce a new stimulus. But the effect is the same. More money, more deposits, more cash waiting for its next destination.

If you found these insights valuable: Sign up for my FREE newsletter! thestockmarket.news

@_Investinq Thank you. Another great thread. So the bottom line is when too late start lower the rates, part of all those trillions will start to flow into the market (and crypto as well) 🍿

@_Investinq Invest in India💥 Value shared freely compounds faster than capital 📈🔥. A solid newsletter💡.

@_Investinq 👆👆👆👆👆👆👆👆👆👆👆👆 DAMN! EXCELLENT thread!!! 🙌🙌🙌

@_Investinq Thank you for the analysis. I’m not sure there is a conclusion in there, though. It sounds like there is a significant chance of high inflation. Is that correct?