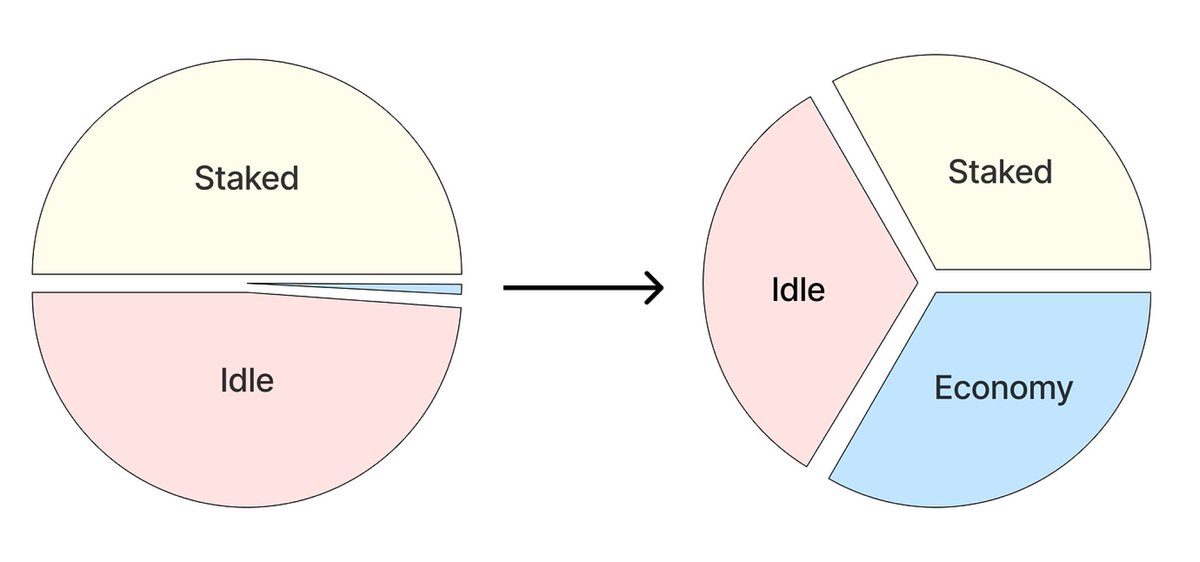

A new proposal has emerged regarding Polkadot’s tokenomics. This could serve as a turning point in addressing one of the biggest pain points that @Polkadot has faced to date. Currently, the value of Polkadot—particularly $DOT—is not adequately reflected in proportion to the level of network activity. One of the main reasons is that the value of $DOT is not sufficiently linked to real economic activity within the ecosystem. Even when rollups grow successfully, most of the benefits are limited to the growth of the rollup itself. The majority of rollups issue their own tokens and build self-sustaining economic systems around them. Within these ecosystems, fees are paid using the native token, and most activities are conducted using that token, leaving little room for $DOT to play a role. In fact, the amount of $DOT held on rollups currently accounts for only about 2% of the total, indicating very low utilization. This is largely due to rollups being designed around their native tokens and also because Polkadot struggles to offer competitive yields against its high inflation rate of over 12%. As a result, the practical utility of $DOT within the broader ecosystem has remained limited. To address this, @alice_und_bob has proposed an alternative approach to enhance $DOT’s utility: distributing a portion of newly minted $DOT—generated through inflation—to rollups based on the proportion of $DOT they hold. If implemented, this structure would drive rollups to compete in attracting more $DOT. Naturally, this would lead to rollup ecosystems offering incentives to users for depositing $DOT, and in turn, finding ways to utilize those tokens within their platforms. This could spur $DOT-based DeFi activity within rollups and ultimately forge stronger economic ties between rollups and the Polkadot network. This approach could significantly increase the utility of $DOT, mitigate the downsides of inflation adjustments, and most importantly, improve the token’s intrinsic value by reinforcing the economic link between rollups and Polkadot. Crucially, this would not be driven by top-down intervention but rather by bottom-up competition among rollup ecosystems, making the process more efficient and sustainable. In conjunction with ongoing discussions around a hard cap, this proposal deserves careful consideration.

A new proposal has emerged regarding Polkadot’s tokenomics. This could serve as a turning point in addressing one of the biggest pain points that @Polkadot has faced to date. Currently, the value of Polkadot—particularly $DOT—is not adequately reflected in proportion to the level of network activity. One of the main reasons is that the value of $DOT is not sufficiently linked to real economic activity within the ecosystem. Even when rollups grow successfully, most of the benefits are limited to the growth of the rollup itself. The majority of rollups issue their own tokens and build self-sustaining economic systems around them. Within these ecosystems, fees are paid using the native token, and most activities are conducted using that token, leaving little room for $DOT to play a role. In fact, the amount of $DOT held on rollups currently accounts for only about 2% of the total, indicating very low utilization. This is largely due to rollups being designed around their native tokens and also because Polkadot struggles to offer competitive yields against its high inflation rate of over 12%. As a result, the practical utility of $DOT within the broader ecosystem has remained limited. To address this, @alice_und_bob has proposed an alternative approach to enhance $DOT’s utility: distributing a portion of newly minted $DOT—generated through inflation—to rollups based on the proportion of $DOT they hold. If implemented, this structure would drive rollups to compete in attracting more $DOT. Naturally, this would lead to rollup ecosystems offering incentives to users for depositing $DOT, and in turn, finding ways to utilize those tokens within their platforms. This could spur $DOT-based DeFi activity within rollups and ultimately forge stronger economic ties between rollups and the Polkadot network. This approach could significantly increase the utility of $DOT, mitigate the downsides of inflation adjustments, and most importantly, improve the token’s intrinsic value by reinforcing the economic link between rollups and Polkadot. Crucially, this would not be driven by top-down intervention but rather by bottom-up competition among rollup ecosystems, making the process more efficient and sustainable. In conjunction with ongoing discussions around a hard cap, this proposal deserves careful consideration.

This proposal could be a game-changer for @Polkadot 's tokenomics! By incentivizing rollups to attract and utilize $DOT, it could create a more robust economic link between rollups and the Polkadot network. The potential for $DOT-based DeFi activity and increased utility is exciting!

@code0xff @Polkadot I don't see this as a viable solution. Parachains have a low TVL value, communities are discouraged by the poor performance of their tokens. Fixing supply and reducing inflation are priorities at this time. @Zou_Block has good suggestions for increasing adoption.